Managing personal finances effectively is crucial for long-term financial success, and a financial coach can be an essential guide in helping you develop the skills needed for smart money management. Whether you’re dealing with debt, trying to save, or simply want to organize your finances better, financial coaching offers practical strategies and solutions tailored to your unique situation. One of the most effective tools a financial coach can use is budgeting. Budgeting is essential for building wealth, cutting unnecessary expenses, and preparing for unexpected financial challenges.

In this article, we’ll explore the top budget hacks recommended by financial coaches for better money management.

1. Track Your Spending: The Foundation of Budgeting

The initial step in developing an effective budget is to monitor your expenditures. Financial coaches often recommend that clients track every expense to gain a clear understanding of where their money is going. This process helps identify areas of overspending, opportunities for savings, and allows you to make more informed decisions about your finances. There are many tools and budgeting apps that can help you categorize your expenses and stay on track with your financial goals.

Budgeting apps such as Mint, YNAB (You Need A Budget), or Personal Capital allow you to monitor your spending, set up financial goals, and track your progress in real time. Once you have an accurate picture of your monthly expenses, you can allocate your income effectively and start working toward your financial objectives.

2. Apply the 50/30/20 Rule for Balanced Financial Management

One of the most popular budget strategies recommended by financial coach is the 50/30/20 rule. This straightforward budgeting approach allocates your income into three categories:

- 50% for essential needs: Rent, utilities, groceries, insurance, transportation, and other necessary living expenses.

- 30% for wants: Discretionary spending like dining out, entertainment, and hobbies.

- 20% for savings and debt repayment: Building an emergency fund, contributing to retirement accounts, and paying off high-interest debt.

This rule provides a clear and balanced approach to managing your finances, ensuring that you meet your needs, enjoy life, and save for the future. It’s an effective way to structure your finances and stay disciplined with your budgeting.

3. Pay Yourself First: A Crucial Step in Smart Money Management

Paying yourself first is one of the core principles of financial coach. This approach prioritizes saving before you spend. Financial coaches recommend that, as soon as you receive your paycheck, you automatically transfer a percentage into a savings or investment account. This method ensures that you’re always saving for your future, even before spending on everyday expenses.

By automating your savings, you ensure that you’re consistently building wealth and working toward long-term financial goals like buying a home, building an emergency fund, or preparing for retirement. Automation also reduces the temptation to spend the money elsewhere, making it a powerful tool for financial discipline recommended by financial coach .

4. Pay Off High-Interest Debt First: The Debt Avalanche Method

Debt is one of the most significant obstacles to financial freedom, and financial coaches often suggest using the debt avalanche method to pay off high-interest debt first. The debt avalanche method involves prioritizing the repayment of debts with the highest interest rates (such as credit card debt) while making minimum payments on other loans.

Alternatively, the debt snowball method is a strategy where you pay off your smallest debt first, providing a sense of accomplishment and motivation. This method can be effective if you’re motivated by seeing quick wins.

5. Automate Your Bills and Savings to Save Time and Money

Automating your bills and savings is a key budget hack that can simplify your financial life. Many people forget to pay bills on time or fail to save consistently, leading to late fees and missed financial goals. By setting up automatic payments for monthly bills and transferring a set percentage of your income into a savings account, you can avoid these pitfalls.

Automating your finances also frees up mental energy and ensures that your bills are paid on time. Additionally, automatic savings ensure that you’re consistently putting money aside for future goals, such as building an emergency fund or saving for retirement.

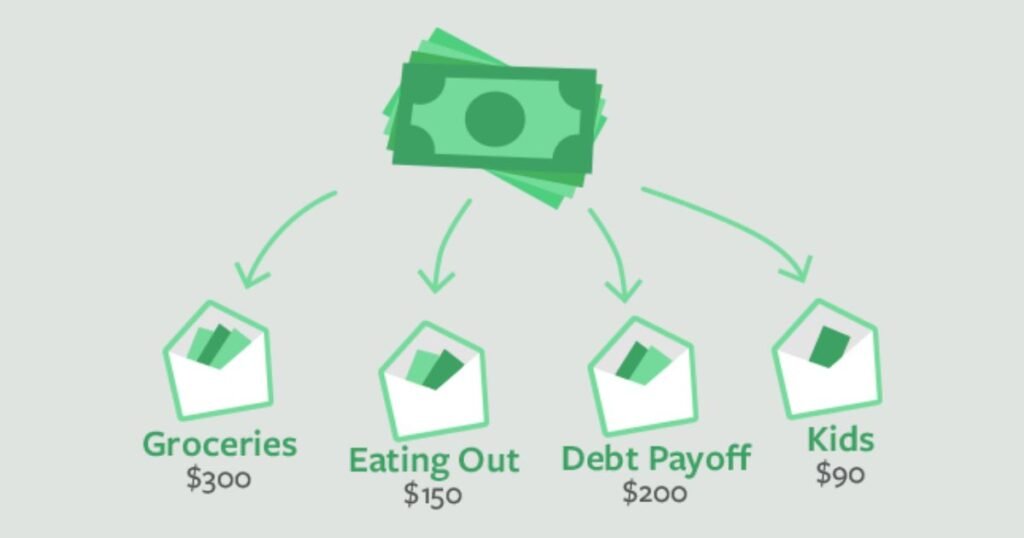

6. Use the Envelope System to Control Discretionary Spending

The envelope system is a traditional yet highly effective budgeting method that involves allocating a set amount of cash to specific spending categories. When the cash in an envelope is gone, you cannot spend any more in that category for the rest of the month. This system is particularly useful for managing discretionary expenses such as dining out, entertainment, or shopping.

The envelope system helps you control impulse spending and ensures that you stay within your budget. If using cash is impractical for you, there are digital versions of the envelope system available through apps like GoodBudget or Mvelopes, which allow you to allocate money to different spending categories on your smartphone.

7. Regularly Review and Adjust Your Budget

Your financial situation is dynamic and constantly changing, which is why it’s important to review and adjust your budget regularly. Financial coaches recommend reviewing your budget at least once a month to account for any changes in your income, expenses, or financial goals. For example, if you receive a raise or pay off a loan, you may want to adjust your budget to reflect these changes.

Regularly reviewing your budget helps you stay on track and make necessary adjustments to continue working toward your financial goals.

8. Cut Unnecessary Subscriptions and Expenses

In the modern world, it’s easy to accumulate unnecessary subscriptions or make impulsive purchases that impact your budget. Financial coaches often recommend auditing your subscriptions and recurring expenses to identify services or products you no longer need.

Common culprits include magazine subscriptions, streaming services, and memberships. Cutting back on these unnecessary expenses frees up money that can be better allocated toward essential needs, debt repayment, or savings.

9. Embrace Frugality Without Sacrificing Quality

A financial coach will often encourage you to embrace frugality—the practice of living below your means without sacrificing quality of life. Frugality isn’t about depriving yourself; it’s about making mindful and intentional financial decisions. This could include shopping for sales, meal prepping at home instead of dining out, or buying quality used goods rather than new.

Being frugal means finding ways to get the most value for your money, which will allow you to meet your financial goals faster while still enjoying a fulfilling life.

Budgeting Hacks Summary Table

| Budgeting Hack | Description |

| Track Your Spending | Use apps or tools to monitor and categorize every expense, allowing you to identify areas for savings and financial improvements. |

| 50/30/20 Rule | Divide income into 50% for needs, 30% for wants, and 20% for savings/debt repayment. |

| Pay Yourself First | Prioritize savings by automatically transferring a portion of your income into savings or investment accounts before spending. |

| Prioritize High-Interest Debt Repayment | Use the debt avalanche method to pay off high-interest debt first and minimize interest payments. |

| Automate Bills and Savings | Set up automatic payments for bills and transfers to savings to avoid late fees and ensure consistent saving habits. |

| Envelope System | Use physical envelopes or digital alternatives to allocate a set amount of cash to different spending categories and avoid overspending. |

| Review and Adjust Your Budget Regularly | Regularly review and adjust your budget to reflect changes in income, expenses, or financial goals. |

| Cut Unnecessary Subscriptions and Expenses | Audit subscriptions and recurring expenses to eliminate unnecessary costs and redirect funds toward financial goals. |

| Embrace Frugality Without Sacrificing Quality | Be intentional with spending by seeking bargains and making smart choices that help you save without compromising on quality. |

Conclusion

A financial coach provides valuable insights and actionable strategies to help you master your budget, save for the future, and pay off debt. By following these top budgeting hacks—tracking your spending, applying the 50/30/20 rule, automating your savings, and embracing frugality you can make smarter financial decisions that will lead to long-term financial stability. Start implementing these budgeting strategies today to take control of your finances and set yourself on the path to financial success.

Thanks for visiting budgethackscwbiancamarket.com. Don’t forget to share it on Twitter.